Latest News

As of January 9, 2026, the EV Tourism Corridor Charging Program is open to new hotel applications and to previous applicants placed on hold due to funding availability, regardless of site type. Funding is available on a first-come, first-served basis.

If your application was previously placed on hold due to funding availability, you must agree to the new Terms & Conditions and confirm your interest via email on or before 5:59:59 p.m. EST January 23, 2026. Additional instructions were sent to applicants by email from NJEVTourism@energycenter.org.

New applicants must apply in the online portal. Visit the program webpage for more information.

Charge Up New Jersey makes it easier and more affordable to go electric by offering up to $4,000 in incentives to buy or lease a new, eligible battery electric vehicle (EV). State incentives save you money up front with savings applied directly at the point of sale. With more than 50 eligible models at a variety of price points, there’s an EV for everyone.

Drivers who switch don’t have to deal with gas stations or unpredictable gas prices — they enjoy lower fueling and maintenance costs, a smoother driving experience and convenient charging. You can even receive up to $250 toward purchasing and installing a home charger, with over 40 eligible models to choose from. With stackable incentives from your utility, you may be able to save even more.

Other benefits of driving electric? Less noise and air pollution — which means fewer health risks for families, especially children and older adults. Every electric mile driven helps create healthier, quieter and safer communities while reducing greenhouse gas emissions.

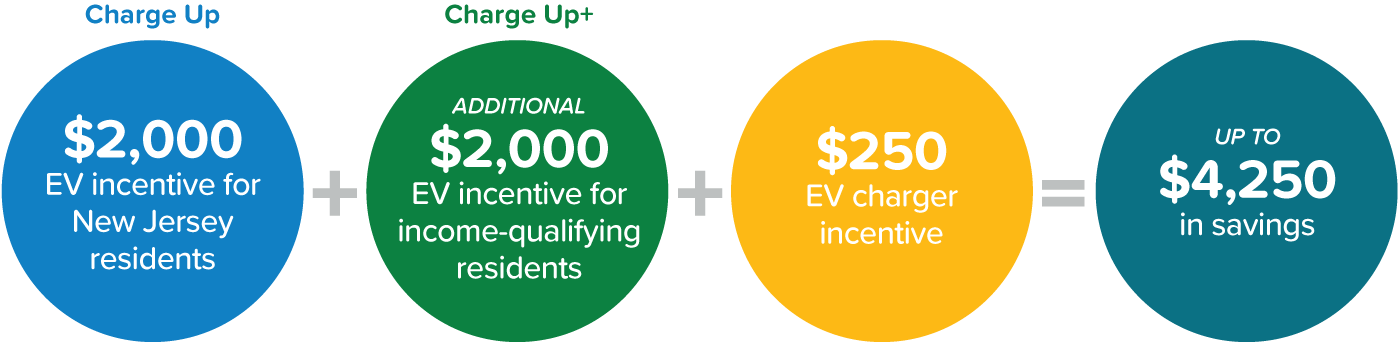

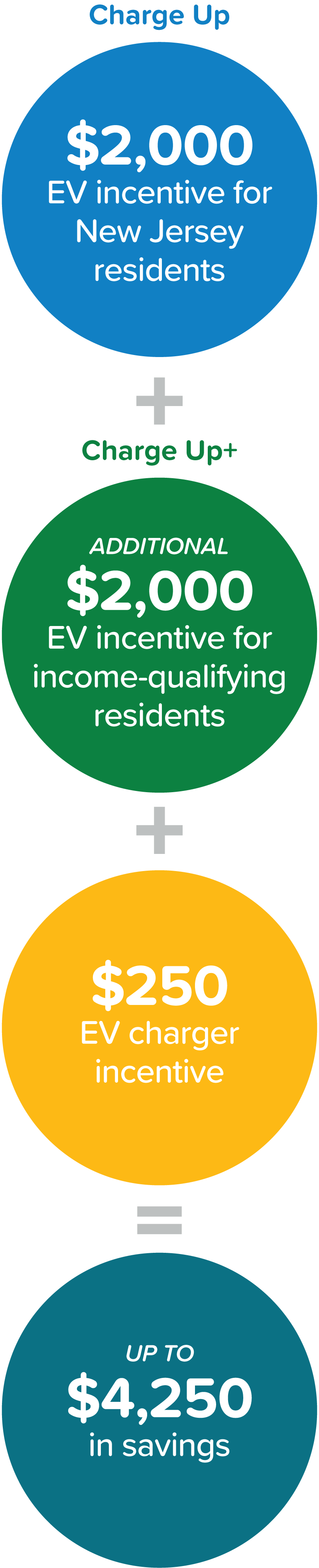

How Much Can I Save?

Residents can take advantage of the Charge Up New Jersey incentive directly at the car dealership or showroom to apply the incentive instantly to their purchase or lease at the point-of-sale.

Charge Up

The Charge Up incentive provides $1,500 to eligible New Jersey residents for the purchase or lease of a new eligible EV.

Charge Up+

The Charge Up+ incentive provides an additional $2,500 for income-qualifying applicants, for a total incentive of $4,000.

EV Charger Incentive

Charge Up New Jersey also offers up to $250 for the purchase of a qualifying Level 2 charger through the In-Home EV Charger Incentive.

You may also be eligible for savings from other state, local and utility programs for EVs and EV charging.

Visit the New Jersey EV Savings Hub to learn more.

Automakers and dealerships may offer even more savings. Find a Charge Up New Jersey eligible dealer.

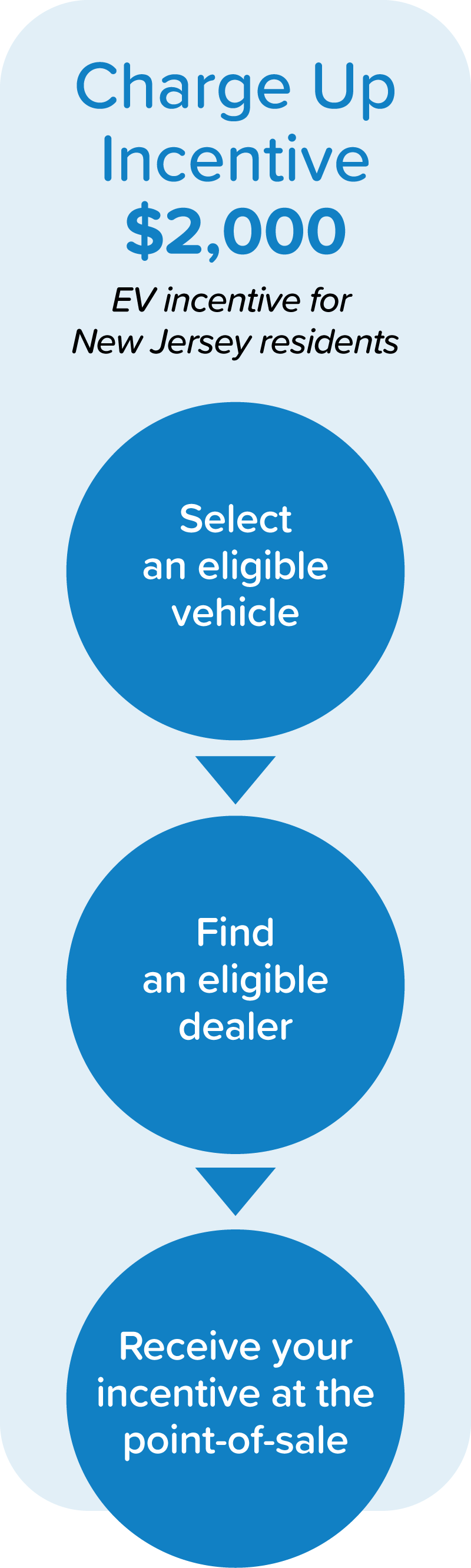

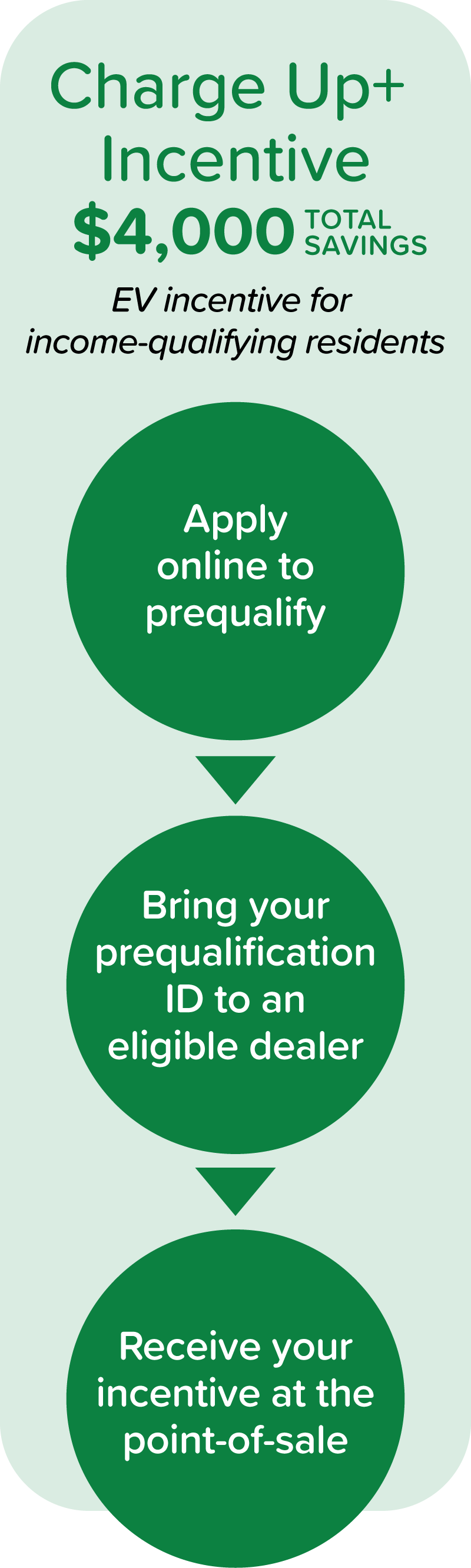

How to Claim Your Incentive

Claiming your incentive is easy!

For the $1,500 Charge Up incentive, an eligible dealer will apply the savings instantly to the purchase or lease of your new vehicle. The dealership will then submit an application on your behalf for reimbursement. No further action is needed after you have received your incentive at the point of sale.

To claim the $4,000 Charge Up+ incentive, you must prequalify prior to the vehicle’s sale or lease. Visit the Eligibility Guidelines page to learn more about prequalification requirements.

To claim the $250 EV charger incentive, you must submit proof of purchase and other supporting documentation through the customer dashboard.

Available Funding

See real-time total available funding status for EV and charger incentive programs.

Please note: Funding is reserved only for EV and charger applications that are successfully submitted. Funding will be replenished in the event a submitted application is canceled. The funding amount of $215 million for EV incentives includes total funding allocated for fiscal years 2022, 2023 and 2024 ($30 million per year), 2025 ($75 million) and 2026 ($50 million).

Testimonials

"The dealership handled everything. I would not have bought an EV if the incentive wasn't there."

-Daniel

"The process was simple since the rebate came off at the time of purchase. Charge Up New Jersey made it easier to afford an EV."

-Steve

"Sign up was a breeze. The incentive played a part in our final decision to buy an EV."

-Bob